Shocked at Your Property Tax Bill?

Shocked at Your Property Tax Bill?

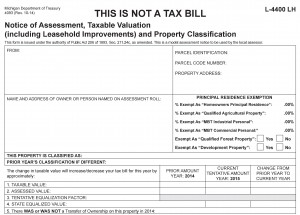

Many homeowners are receiving tax bills that don’t seem to be in line with the real value of their homes. With many real estate markets changing rapidly, it pays to find out for sure. We can help.

In our our property tax appeal practice we generally recommend dividing the assignment into three phases:

1) Initial Phase – Inventory Property. Review assessment records and tax bills to ascertain errors and potential appeal (discovery) risks; inspect the property to confirm physical and functional characteristics and determine sources of depreciation; identify the valuation dates for the property under appeal; and research the market for general pricing analyses. The goal of the initial phase is to gather sufficient information to formulate a firm cost for the middle and final assignment phases (formal appraisal and testimony) and gather enough information so the client can assess the risks/rewards and determine if proceeding with the tax appeal would be an economically feasible endeavor.

2) Middle Phase – Develop Value Opinion. Perform the Appraisal by determining the scope of work; reconfirm the effective date(s) of valuation; market data collection and analysis; develop the estimated value; write the appraisal report.

3) Final Phase – Defend Value Opinion. Prepare for and offer testimony at the Tribunal (if needed); review opposing party’s disclosures and offer analysis of strength and weakness.

Each of the three phases are independent of the other and we price them separately on a case by case basis so the client can elect to proceed with the next phase at their discretion. For a typical residential improved property the pricing is $200 for initial phase, $400 for middle phase and $400 for final phase.

Give us a call today and we can discuss the details of your situation and get started before your next tax bill is due.